2014

Ramsey City Council backs down from “Franchise Fee” to fund roads.

The current council majority says they need to steal raise funds from the residents of Ramsey for roads in the form of a new “franchise fee”. The current majority had the opportunity to budget for road funding in the current levy, but refused to do the hard work and tell the residents what was needed, instead trying to get more money in the form of a “franchise fee” collected by utility companies, and then still claim they did not raise taxes too much. In fact, the addition of a franchise fee will be the equivalent of raising actual taxes up to 18% for some residents, unequally and unfairly; forcing lower income people and lower valued property owners to pay more than higher valued property owners.

The current Ramsey majority says they need 2.2 million dollars for 5 years to deal with roads, but as stated earlier, refused to include this in their 2014 budget. The current majority was left 1.3 million dollars by the previous council, allocated for roads. What has happened to it? What was it spent on?

From an email sent to council members:

• A question was asked about what happened to the $1.3 million that was programmed for 2013. Below is an (honest?) accounting of the dollars provided by finance:

Road Long-term Funding

2013 Budgeted 1,327,500

2013 Street maintenance contract (spent) (378,716)

Remaining Budget Balance $ 948,784

Revenue Shortage Engineering Staff Time (425,813)*

Revenue Remaining $ 522,971

PIR Fund not used (not transferred) (219,493)

Remaining Possible Road Funding $ 303,478

Please, I’m laughing my ass off at any suggestion that almost 426k was spent on extra/overtime hours for existing engineering staff. That’s 4-5 FTE salaries for one year.

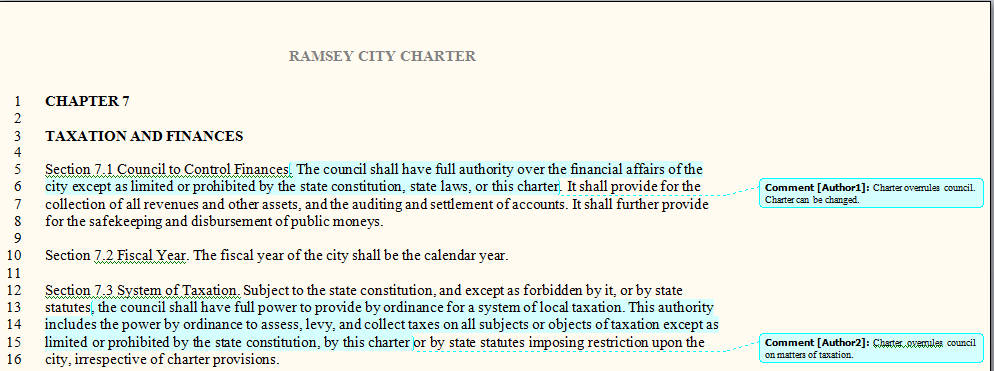

These actions: not budgeting properly and wasting hundreds of thousands on only God knows what, are exactly why the Charter Commission needs to limit the ability of the Council to use franchise fees to arbitrarily take money from residents for dubious schemes.

More 2014

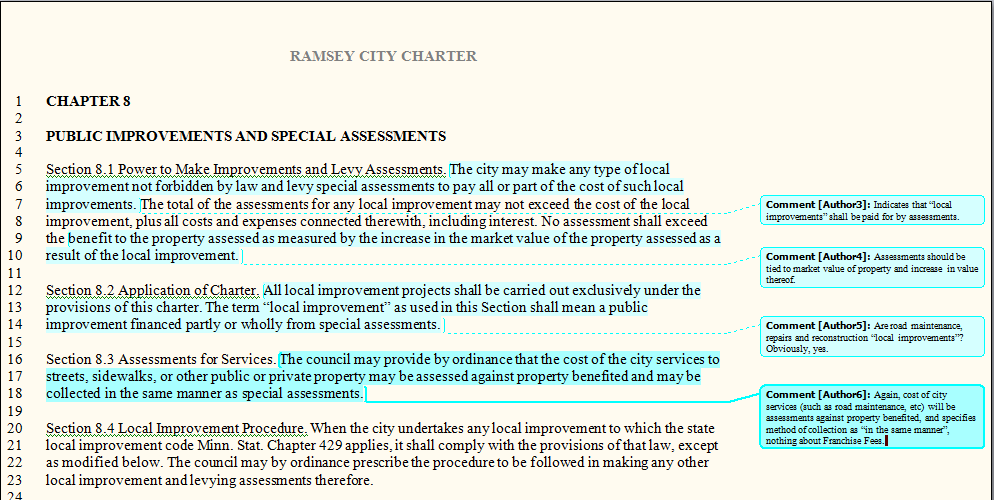

The outcome of the most recent Charter Commission meeting was probably the best that could be expected. The City Council backed down from trying to implement an extremely unfair and regressive tax on residents, which would have put a very disproportionate percentage of the tax on the lowest valued properties and allowed those with higher valued properties to pay much less in “franchise fees” than in property taxes. The Charter clearly states that charges for improvements such as roads should be directly related to the increased value accruing to the property, and the franchise fee would’ve done just the reverse.

The Charter Commission, to its credit, agreed that the percentage of affected residents allowed to block a road project should be raised and settled on a recommendation of 60%, although a slightly higher percentage was suggested.

In response to the Council’s strong hint that “Franchise Fees are dead”, the Charter Commission also backed down from placing a vote by the residents on allowing “Franchise Fees” to be used for various forms of city funding, in parallel with other taxes, on the ballot in November. If the council tries to create a parallel, uncontrolled funding source by using “Franchise Fees”, the Charter Commission is committed to take up the subject again, by proposing, then tabling an amendment to the City Charter.

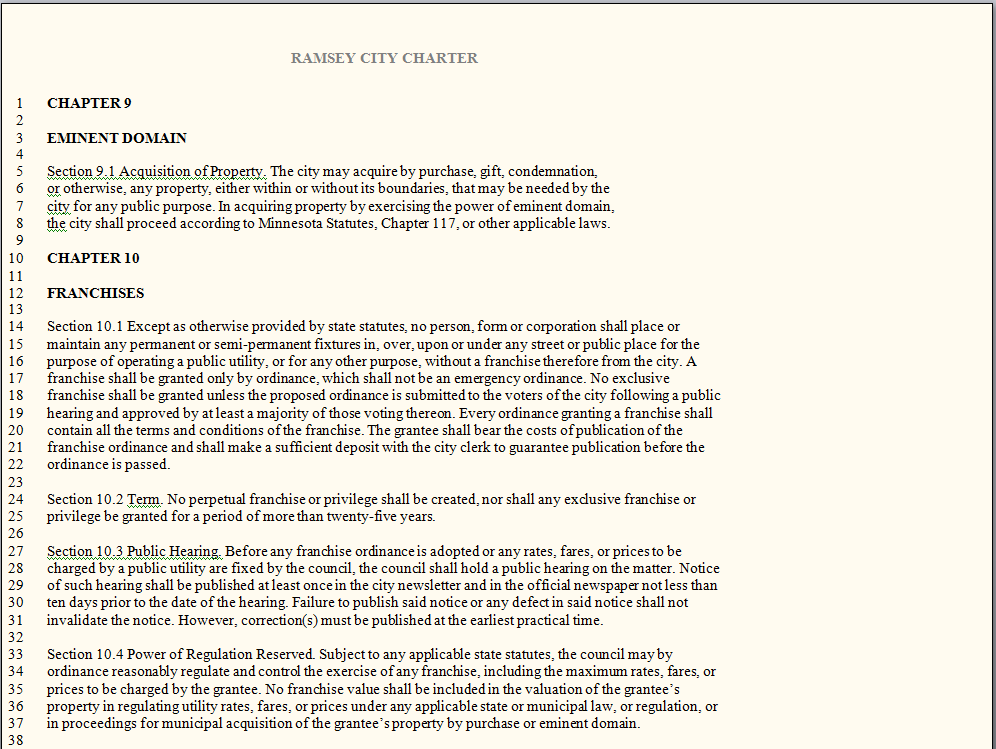

The City of Ramsey Charter Commission proposed to add language to Chapter 10 of the City Charter to do one thing: limit the use of any franchise fee charged to any costs incurred by the city directly related to the franchisee’s infrastructure, not “local improvements” such as general road construction. The Charter Commission has also expressed a strong interest in dramatically reducing the percentage of projects paid for by direct special assessments, instead, putting city wide road construction and maintenance into the general property tax levy where it belongs.

The Charter Commission strongly recommended to the council that they consider reducing the assessment percentage significantly, to reduce the large hit on property owners, and place the remaining cost in the tax levy, where it should be. This also has the effect of spreading the costs out over all residents, but in an equitable manner.

Despite differences of opinion (sometimes dramatic) on other issues, even the least conservative members on the Charter Commission joined in agreement that the “Franchise Fee” solution was not a good one for the residents of Ramsey. It’s good to have checks and balances.

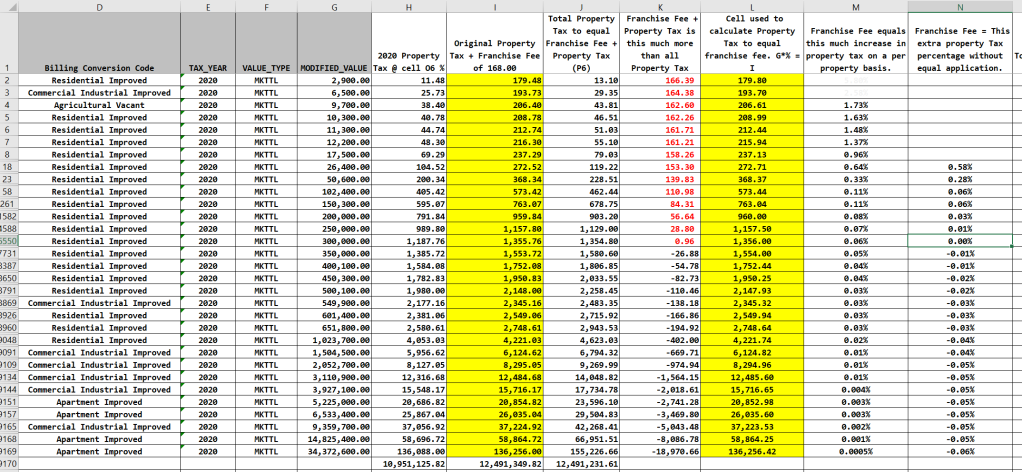

2014 Spreadsheet on Franchise Fees vs additional Property Taxes.

2019

In 2014, the cowards at City Hall considered the dishonest tactic of imposing “franchise fees” to collect money for roads in 2014, because they are unable to convince the people whose neighborhoods’ need them fixed or replaced, to pay for them, using the current system of assessments. Assessments mean that a project for a designated area will be paid for with 75% coming from general property taxes, and 25% from assessments charged to those with an address or frontage on that area of road.

They proposed implementing an 8.00 fee for each electrical meter and gas meter, (16.00 total per month, 192.00 per yr.) and have the fees collected by the utilities providing those services. What do electric and gas services have to do with roads? Nothing at all.

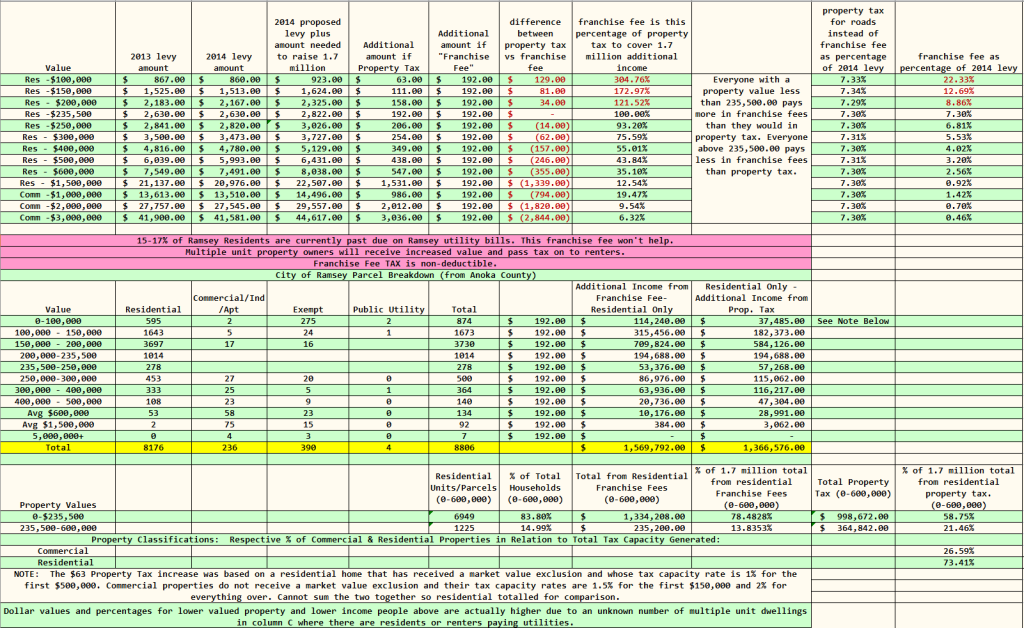

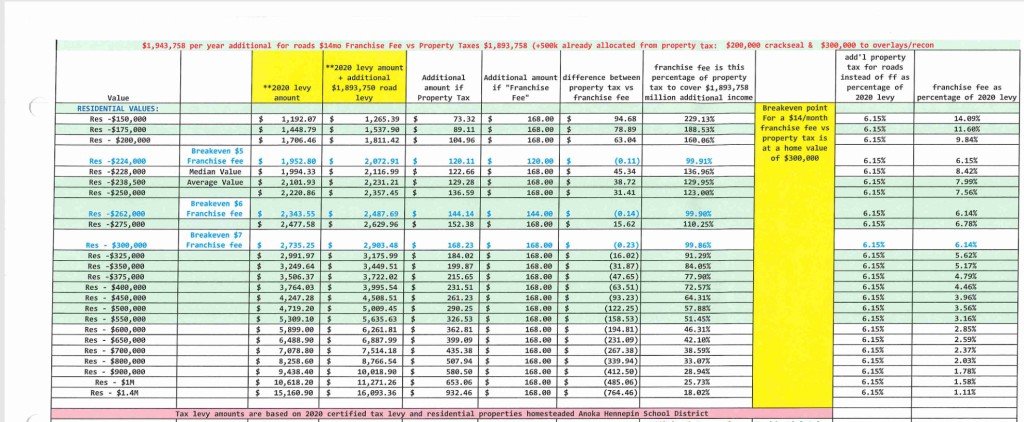

At that time, the city estimated it needed 1.7 million to begin funding a road improvement program. The spreadsheet below analyzed how much residents would pay in franchise fees vs. the current method of taxes and special assessments. What it demonstrates is that the “franchise fee” proposal is an extremely regressive, and unfair method of funding which charges the lower levels of property value the most, and the highest property values, less.

The city charter specifically states that all local improvements shall be carried out under the provisions of this charter. The term “local improvement” as used in this section shall mean a public improvement may be financed partly or wholly from special assessments. Turns out no one wants to pay assessments.

By definition: a “franchise fee” is a fee charged to utilities who want to use city property or right of way to install and maintain the infrastructure to provide their services, or for the right to do business in the city. The only reason cities call this tax a franchise fee, is because that way they can get the utilities to collect it, and pass it through to residents.

In 2018, the city voted to pay 40K to consulting firm WSB & Associates, led by flim-flam man Bret Weiss, a combination of Prof. Harold Hill and Mordecai Jones, to try and sell residents on the snake oil idea of allowing a franchise fee. This was before the LWV forum, where Letourneau pretended the direction of the council and staff was undecided. That was a lie.

The first presentation was billed as an “Open House on road construction funding options”. BS. The WSB huckster spent 5 min. each, criticizing 2 of the 3 options, assessments and property taxes, then launched into a 60 min hard sell on franchise fees. It was obvious this was a polished performance he’s given on hundreds of occasions, with nothing genuine except the practiced, polished preparation. He ducked and dodged the question of why residents all over the city in areas with roads which won’t need any work for 20 years, and those living in apartments and don’t own property, or don’t even drive, should pay for streets in NorthFork, and Royal Road, because those who live in those areas refuse to pay for their local improvements. “life isn’t fair” he said, “no system is perfect” he said. The city hired a snake oil salesman to try to sell people on the idea that they should feel privileged to pay for raising their neighbor’s property values.

2020

The Ramsey City Council has raised taxes DRAMATICALLY for over 70% of residential property owners, only you can’t deduct them.

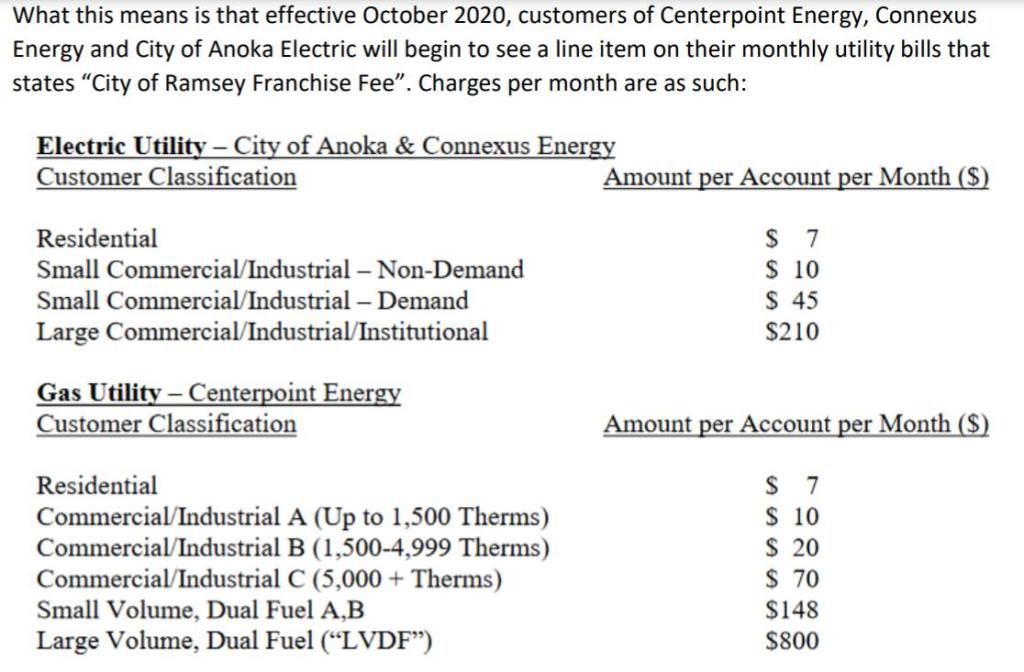

Ever heard of a “franchise fee”? A Franchise Fee as implemented by the current City Council majority is a hidden TAX. The current Ramsey council majority voted to charge every person’s electric bill and gas bill 7.00 EACH per month, or 168.00 per year, and call it a “franchise fee”, but use the money to pay for roads, instead of putting road construction in the general tax levy where it belongs. This “franchise fee” the city council wants to collect equals approx. 1.5 million in additional taxes for road maintenance and reconstruction. “Franchise Fees” are the wrong solution to funding road construction.

The “Franchise Fee” tax is a corrupt fraudulent use of the definition and concept of a franchise fee.

I don’t know whether the city attorney bothered informing the city council that there is precedent that “franchise fees” are quite susceptible to being overturned, as they have been by the MN Supreme Court.

https://www.americanexperiment.org/2016/09/minnesota-supreme-court-ruling-st-paul-fees-already-statewide-impact/

https://www.brainerddispatch.com/news/government-and-politics/3976886-Court-of-Appeals-overturns-ruling-in-BaxterBPU-franchise-case-Baxter-cannot-require-franchise-fees-from-BPU-court-states

The “franchise fee” is supposed to be charged to a utility, such as cable TV or internet provider, for costs to the city of maintaining infrastructure used by the utility, and being allowed a “franchise” to do business in the city, not a direct tax on residents.

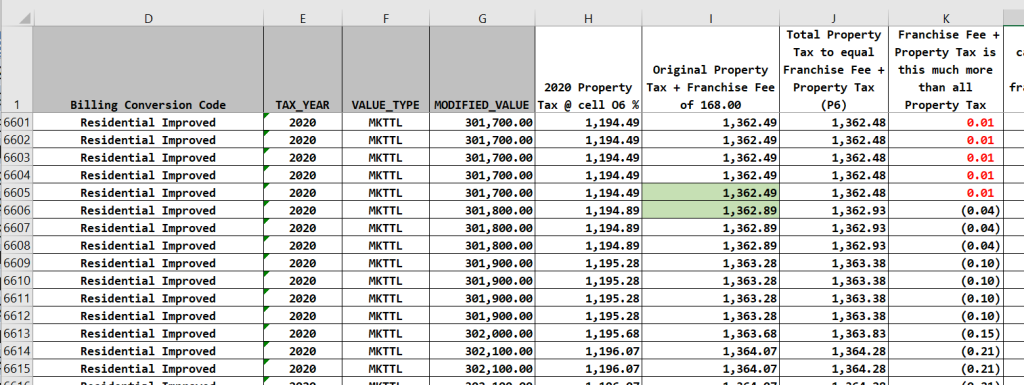

The majority of residents (>70%) will pay MORE in “franchise fees” than they would in increased property taxes. The break point is approx. 301,700.00 in residential property value. Everyone with a property valuation below that, will pay MORE in “franchise fees”, than they would in increased property taxes. Everyone with a property valuation above 301,800.00, will pay LESS in “franchise fees” than they would in property taxes. These numbers have been verified with the city. The approx. property tax increase to equal the amount raised by “franchise fees” would be 6%. Using franchise fees, instead of property taxes, owners of residential property valued below 301,700.00 will pay more than 6%, ( most 6-11%) and those with property valued above 301,700.00 will pay less than 6%.

The question is whether 168.00 per year per resident, is more or less than the extra amount of property tax that would be needed to raise the same total amount of property taxes at the same percentage for all residential property ?

Using “franchise fees” for road funding is an extremely regressive tax because it taxes those who have no house, or property value, or doesn’t even own a vehicle, to pay to increase the property values and net worth of their more affluent neighbors.

In a big kick in the groin to businesses, they will be charged a sliding fee based on their utility usage.

What does electric or gas usage have to with road costs? Nothing.

Gas and electric usage for restaurants, and electricity use for a welding shop are obvious examples. Coborns will get nailed. No business will be charged for road maintenance based on their road frontage or property value.

Property taxes are deductible if itemized. The “franchise fee” is not.

People with lower valued properties get hit twice. Pay more than property tax, and not be able to deduct it.

After this “franchise fee” hidden tax is charged, they’ll still come back and demand higher taxes, saying “the franchise fee, isn’t a tax, so…”

The city also stated they won’t consider reducing taxes by the amount currently collected for road maintenance and construction. (500k per yr.), because they’d have to raise the “franchise fee” “too high”.

Any apartment or townhouse renter with a separate gas and electric bill, would be charged for those, even though they don’t own the property, or benefit from any increase in value of the property. Seniors in living centers will pay, whether they drive vehicles or not, if they have a gas and electric meter.

More policy hypocrisy, by LeTourneau, Menth, Riley, and Kuzma. VOTE THEM OUT!

======================================================================

Technical Explanation

I got the property tax id numbers from the Anoka County Tax Assessor’s office.

Each property tax id number had a taxable market value associated with it.

I dropped the entire list into a spreadsheet, lowest to highest, and counted the rows.

Row 6605 (-1 for header = 6604) is property value 301,700.00, where the franchise fee vs property tax breakpoint is. That means all properties below 301,800.00 pay more in franchise fee than they would in additional property taxes.

6604/9168 = 72%

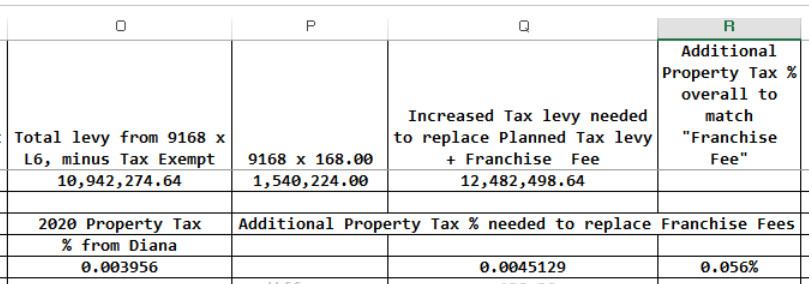

As for the percentage of additional property tax:

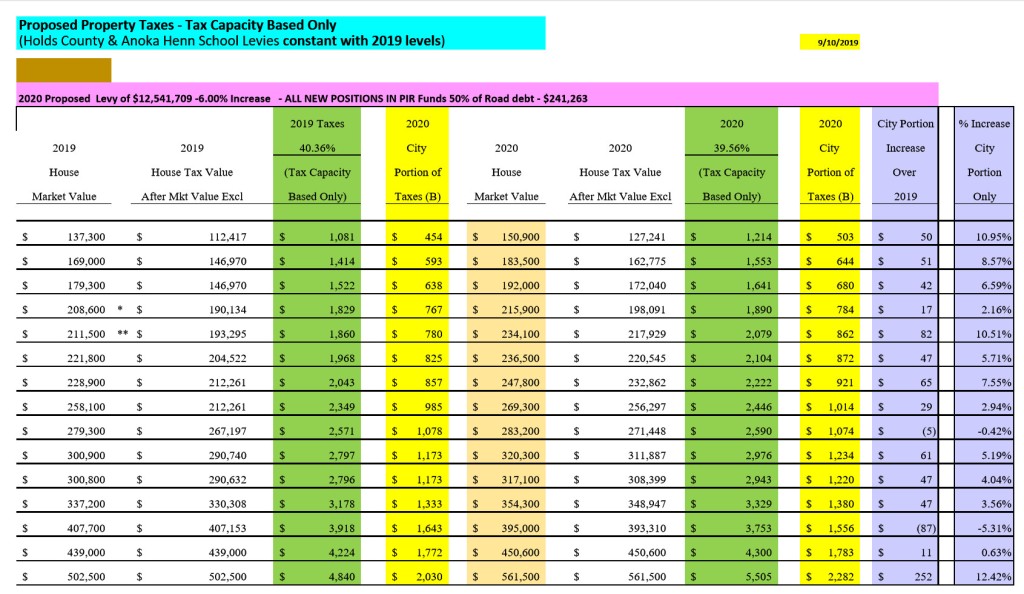

The calculation for Ramsey’s city portion of property tax came from a small spreadsheet in the notes for city council budget meetings, with some representative values and taxes presented by the city finance director.

The number for current property tax calculation is 39.56%. I tested this percentage against the market values I got from Anoka County and got the same numbers as are in the city document.

I multiplied every property value by 39.56%, and totaled that to get the total for property taxes.

I added 168.00 to every property value to get the number for franchise fee total for each property’s franchise fee vs property tax comparisons.

I multiplied 9168 x 168.00 to get the amount of money which would be raised by a franchise fee.

I added that number to the basic property tax to get a new total.

I then tested various percentages to find out what percentage x each property value would equal the total original property tax + total franchise fee amount. That percentage – the original property tax percentage rounds to 6%, it’s actually 5.56% in my spreadsheet.

Below is the City Finance Director’s version of my spreadsheet from 2014 on the franchise fee calculations. It’s not an exact match, but extremely close, so I know these numbers are good. She has very close matches for break points, and her calculation of additional property tax percentage if applied across the board, is slightly higher than mine. I’ll stick with approx. 6%.

Directly below is a condensed version of my spreadsheet with actual dollar value break points starting at 25k and above. The bottom line is that over 70% of Ramsey Property owners are going to pay more in franchise fees than they would in additional property taxes.